Welcome to Contrarian Thinking, where we help you think smarter, build better, and live freer.

This week, we share 7 strategies for living a more fulfilling life from one of Codie’s closest mentors.

Let’s dive in…

This is Bill Perkins.

Hedge fund manager. Poker player. Asymmetric thinker. Worth hundreds of millions.

Today, you’ll steal 7 of his principles for living a truly rich life, starting with…

1. Never Let “Small” Infect Your Thinking

Bill doesn’t do polite encouragement. He does reality checks.

Codie once shared her business vision with him — safe, reasonable, probably doable. He paused, looked her in the eye, and said: “Has small infected your thinking?”

It wasn’t rude. It was a gift.

Sometimes, playing it safe feels smart… when it’s actually just playing small.

Most people don’t have anyone in their life who will call that out. Bill will.

2. Slow Is Expensive

“We’re human beings, not institutions. We don’t live that long,” Bill says.

Rich people aren’t usually much smarter. But they are often much faster. Bill calls it what it is:

While most people are still planning step one, the best have already failed 4 times, maybe even lost money, and figured out the faster, better path to reach their goal.

3. Leave Your Ego at the Door

Bill has a spicy take:

If you’re educated, healthy, and halfway ambitious, you have no actual financial risk. You’re not going to starve or be homeless, he says. You can get a job — maybe not a glamorous one, but a job — any day of the week.

What you probably have is “ego risk.”

That idea hit home for Luke, a veteran and the CEO of our portfolio company, SkyFi:

“People aren’t afraid of failing, they’re afraid of looking stupid,” he says. “That ego trap costs them real opportunity.”

4. Fire Yourself to Grow

There’s a massive difference between owning a business and that business owning you, Bill says.

The sooner you step back from the oven, the sooner you can start opening more doors.

“I love to fire myself,” he told us. “That’s how you build an empire.”

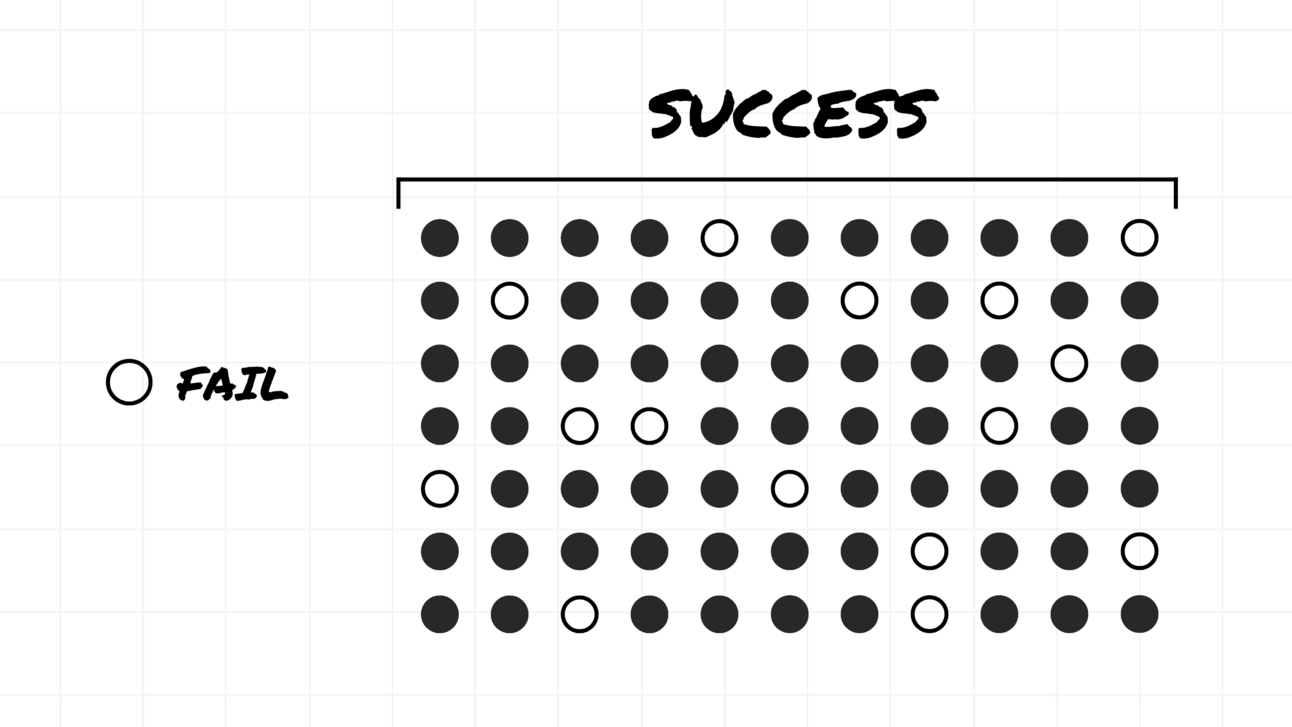

5. Failure Is Data

Bill once lost $10 million on a failed energy project in El Salvador.

“It failed miserably… I lost $10 million when $10 million was a significant portion of my net worth.”

Most would call that a disaster. He calls it part of the process — data collection.

“I’m OK looking like an idiot. And I often do.”

You don’t need to burn millions like him to learn this lesson:

No shot, no progress.

6. Money Is Worthless (If You Don’t Use It)

“If I want to go heli-skiing,” Bill says, “it’s not at 86.”

Money has a shelf life, and it expires faster than most people think.

There’s a window when the money actually matters — for joy, adventure, and memory-making. Miss it, and all you’re left with is digits in a bank account.

Timing, not just saving, is what makes money useful.

7. Generosity is the Flex

Bill tells a story about his friend Greg.

Greg took his brother on a ski trip and tried to cover the hotel. His brother refused.

Greg: “If I owned a house and invited you to stay, would you pay?”

Brother: “No.”

Greg: “Then save me the $3 million and let me pay for the hotel.”

That’s the mindset.

Bill doesn’t buy boats or houses to sit in alone. He buys them to share experiences. Not to show off. To create memories.

HIGH SIGNAL

The Builder’s Feed

👉 If I were you: Ask yourself this question, says Nvidia’s CEO.

📷 Image of the week: Simplicity takes work — here’s the proof.

🖼️ Game-changer: The smartest way to sell a service in 2025?

📅 Save your spot: How to buy your next cash-flowing business.

DOPAMINE HIT

What’d you think of this week’s newsletter?

Hit reply to let us know. How ya feeling? Did we crush it? Blow your mind? We read every response.

Want more where that came from?

Head to our website here.