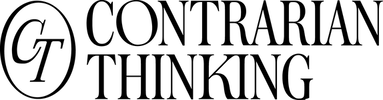

In 2020, Peter Thiel sent an email that aged like a fine wine.

He was applying basic incentive math:

If… you load a generation with student debt.

If… housing becomes structurally unaffordable for them.

If… it gets too difficult for them to accumulate assets.

Then… you shouldn’t be shocked when they turn against capitalism.

If you don’t own anything, you can’t benefit from an economy that’s designed to increase asset values.

FROM CONTRARIAN THINKING

This February, Learn How to Acquire a Business

Now Fast Forward to Today. As in, Literally Today…

Last night, Democratic Socialist Zohran Mamdani was sworn in as mayor of New York City, the financial capital of the world. Young voters backed him overwhelmingly.

His platform promises include rent price freezes, free childcare, and free public busing, paid for by higher taxes on the wealthy and corporations.

The immediate reaction from critics has been understandable: claims that young people are entitled, economically illiterate, or infected with socialism through TikTok.

Whether or not that’s true, capitalism depends on participation. Without it, the system loses its defenders.

If you want the next generation to be pro-business, you have to make it easier for them to do business. That means creating real on-ramps to ownership, not just telling people to “trust the process.”

Right now, trust is thin. And everywhere you look, there are few reasons for it to thicken…

For Example, Look 3,000 Miles West

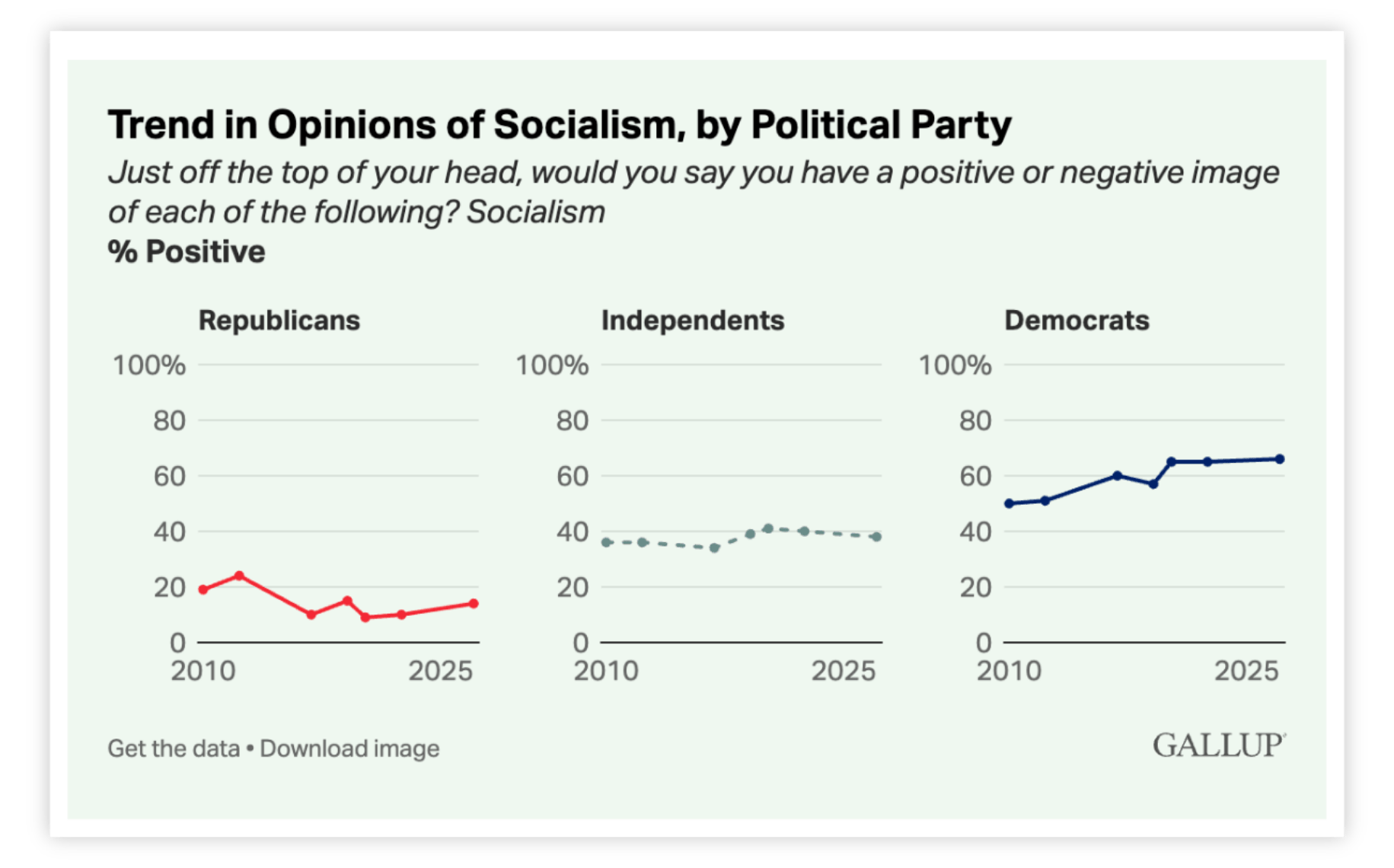

Right now, California is staring down the barrel of a consequential tax debate.

A coalition wants to put a ballot measure before voters that would impose a significant tax on the net worth of Californians with more than $1 billion in assets.

If passed, it could raise billions of dollars. However, this is not a corporate tax on profits or receipts. This is a wealth tax on unrealized capital gains.

Critics argue this tax punishes business builders who create millions of jobs and enormous economic value, disincentivizes local investment, and could weaken California’s advantage as a global innovation engine.

Understandably, critics also question why yet another massive pile of tax dollars would be any more effective than the last.

For California, this could also backfire. If you incentivize builders to leave, you could lose out on billions of dollars in future taxes if those business owners and investors do, in fact, leave.

What About Minnesota?

This week, you may have also seen headlines centered around alleged longtime funding fraud across Minnesota social services, including in child care, health centers, and food programs.

The latest drama was ignited by a viral video claiming that multiple day care centers were receiving taxpayer money while providing little to no services, with one center’s logo even ironically misspelling “learning center” as “learing center”. Not a joke.

The video spread like wildfire and is closing in on 150 million views. This was essentially the public’s reaction:

It also drew the attention of political and law enforcement officials.

Federal prosecutors have now alleged that half (or more) of roughly $18 billion in federal funds tied to multiple Minnesota programs since 2018 may have been misappropriated and are investigating them further.

Snowball Effect

Another pattern we keep running into, often right after conversations about fraud and institutional failure, is the explosion in gambling and high-risk financial behavior across the U.S.

Betting and prediction markets have grown at a near-vertical rate, moving tens of billions annually after being almost nonexistent just a few years ago.

The scary part? Participation is concentrated among the same generations facing the weakest expected returns from conventional career and wealth-building paths.

A 2023 study found 19% of 18 to 24-year-olds qualified as having a gambling problem (betting more than they could afford, chasing losses, etc.)

A 2025 Credit Karma survey found that nearly half of sports bettors or their partners “have experienced mental health issues like depression as a result of sports betting activity.” Of Gen Z bettors, 37% said they had a gambling addiction.

As one writer put it: “When you’re trapped, your risk preferences change… For a generation that sees no realistic path [to wealth and ownership] through conventional means, the expected value of a moonshot starts looking better than the expected value of grinding.”

For decades, our social contract was built around delayed gratification. You showed up consistently, advanced slowly, and trusted that time itself would do half the work for you.

Wealth accumulated quietly in the background through pensions, home equity, and predictable career ladders. That framework is no longer as reliable.

To summarize:

Billions being lost to fraud in Minnesota

A $100B+ New York budget about to be spent rampantly on the same kinds of programs

Higher taxes pitched as the solution to the obvious mismanagement in California

Realizing why people have stopped trusting in institutions and each other

Risk and gambling filling the vacuum as patience stops paying

It’s rough out there. But something we always say in the Contrarian Academy and Growth Boardroom is that we’re builders, not burn-it-downers.

As bleak as it may appear, and as little as it may feel like things are in our control, there is actually quite a lot that you can do.

It’s Time to Invest in Systems

Today also marks the end of an era. Warren Buffett is stepping down as CEO of Berkshire Hathaway, closing a chapter that quietly defined modern American capitalism.

Since Buffett began using Berkshire as his primary investment vehicle in the mid-1960s, the company’s stock price has risen by more than 5.5 million percent.

In this context, Buffett is the godfather of systems investing. What better way to carry his torch than to build ownership in 2026?

As Buffett would point out, investing in businesses isn’t only useful on an individual level. It can be powerful for our society, too, and we ought to do better at it. Consider this excerpt from Noah Smith on why people love Japan so much:

“Japan’s cities have something extra special… I believe that that something is commercial density. Tokyo has an order of magnitude more restaurants than New York or Paris, and the disparity in retail stores is probably similar. Small business is the lifeblood of Japanese cities — and, in many ways, of the Japanese middle class. This might be partly cultural, but at least some of it is the result of deliberate policy. Japanese zoning usually limits the size of stores in mixed-use areas, ensuring that small businesses dominate. The Large-Scale Retail Store Location Law also provides some protection. And Japan’s government provides lots of support for people who want to start small businesses, including a variety of subsidies. This support, along with a culture of craftsmanship, might be why Japan’s independent restaurants and stores tend to stand out in terms of both quality and originality.”

Also, look at the data below.

Small businesses are the most unifying institution in America, according to the Pew Research Center... And it’s not even close.

Investing in and building small businesses pushes back against the multi-front economic battle that’s dividing our country. The bad news is it’s hard, the good news is it’s something you have the agency to achieve.

If owning a business were easy and risk-free, everyone would be an owner. Fortunately, it’s not easy. And you’re not everyone.

As Marc Andreessen said, the world is more malleable than it looks, especially to those who decide what they want and go after it with focus and persistence.

With the right playbooks, tools, and guidance from those who’ve done it, you can form a path to generational ownership and a stake in the future of your community.

In 2026, we’d love to help you get it done.

The clock starts now.

-Team Contrarian

Ready to Learn How to Buy a Business? Start Here.

It’s not rocket science, but there is a science to this. At Main Street Millionaire Live, we’ll help you save time, understand how to do this the right way, and take action with a clear plan.

ONE LAST THING…

If today’s newsletter resonated with you, we have another (free) way to learn even more:

📊 Get the Main Street Minute, the only free newsletter that makes you a smarter business buyer and builder every time you open it.

DOPAMINE HIT

What’d you think of this week’s newsletter?

Hit reply to let us know. How ya feeling? Did we crush it? Blow your mind? We read every response.

Want your brand in front of hundreds of thousands of business builders?

Check out our partnership opportunities.

Want more where that came from?

Head to our website to learn more about our programs.