Let’s say we gave you $3 million to buy a business and become an owner.

Not just any business — the right one for you: Profitable. Proven. A fit for your life.

Think you could pull it off?

Most people probably think so.

“With that kind of cash, I’ll just make an offer and walk away with the keys.”

But that’s not how it works.

Historically, buying a business has looked a lot less like House Hunters…

…And a lot more like The Lord of the Rings.

Sure, money helps, but plenty of people with far less cash manage to close great deals.

So what really breaks most people? The process.

Just ask Sally and her daughter, her business partner.

Sally had experience. She had capital. And her daughter brought serious digital talent. But still:

3 years searching for a business

3 deals fizzled out

$45K in legal fees

0 businesses bought

Until one small shift changed everything.

If you’re building, scaling, or want to own something real in the next few years…

Sally’s story is one you need to hear.

The Tool That Changed Sally’s Life

In 2008, Paul Graham drew the “Startup Curve”, a now-famous sketch of how building a startup actually feels.

We think buying a business follows a similar path:

Today, this process can feel like finding a needle in a haystack… in a dark room.

But what if someone just flipped on the light and pointed you toward the needle?

That idea has always been on our minds.

…And it’s why Sally’s story is so cool.

See, Sally’s not your average buyer.

She’s a high school dropout, who went on to earn 2 master’s degrees.

She co-developed a cancer institute and worked in investment banking.

She’s sharp. Experienced. Well-connected.

Here’s why that’s critically important for you.

Even with those advantages, Sally struggled to buy the right business UNTIL she had the right tools.

In 2021, a friend encouraged Sally to buy a business, and even offered to help back the deal.

All she had to do was find the right one, close, and execute. How hard could it be? 😉

Turns out, pretty damn hard.

Sally didn’t do anything wrong. She was smart, and reached out to brokers on acquisition platforms with her criteria:

$2M-$3.5M price range (remember, there are many ways to finance an acquisition)

Cashflow positive

Established SOPs

Ready to close in 3 months

She just expected sellers and brokers to be hungry like realtors, especially since she was a well-capitalized buyer. But much of what she heard was:

🦗 🦗 🦗🦗 🦗 🦗

(Crickets, in case that wasn’t clear.)

Sally spent 3 years working hard getting somewhere… then nowhere. Painfully, 3 deals came and went:

A waste management company (fell through because the family couldn’t let go)

A dinosaur exhibit in Scottsdale (seller kept trying to steal trademarks)

A med spa in Beverly Hills (owner had fake PhDs from diploma mills)

Then she saw a tweet about a new acquisitions platform called BizScout.

She didn’t have much to lose by checking it out.

She logged on, built her profile, and got 2 matches:

1. A log cabin playground business

2. A women’s clothing boutique

Before this, Sally hadn’t considered retail.

But she was curious about the boutique, and decided to investigate.

She walked in, spent time in the store, got back in her car, and looked at her partner…

“I think this is it. I think this is the business.”

The business in question turned out to be a solid operation:

20-year-old family business

$3.5M revenue

$800k net

And this time, the sellers were serious about doing a deal.

The deal took about 5 months to close, between diligence and landlord delays.

After 3 years, Sally finally persevered.

Here’s what’s wild, though:

This was months ago, when BizScout’s features were minimal compared to what they are now (and what they’ll be by the end of the year).

All we did was then play matchmaker.

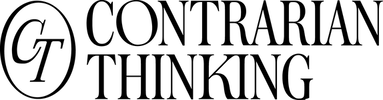

Now, we help guide the whole deal from search, to financing, to due diligence, to close.

If you’re interested in buying a business, you can get:

An Acquisition Dashboard (think of it as a GPS for your deal)

Due diligence checklists (no more guessing what docs to ask for)

SMB financing help (so you can structure your deal effectively)

Buyer criteria matching (like Sally experienced, but better)

An interactive map function to find businesses by location

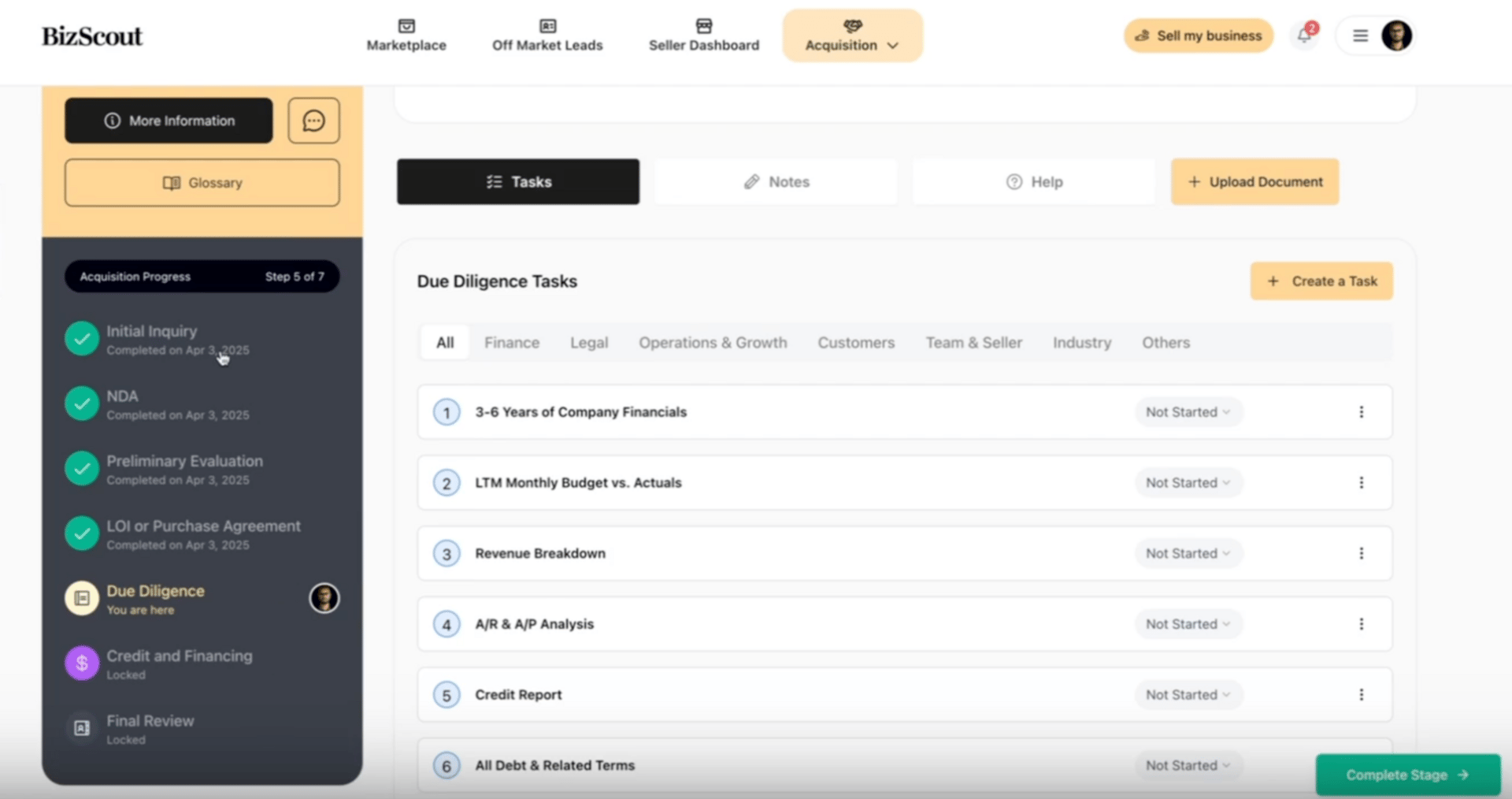

And if you ever want to sell a business, you can list your business and get:

Pre-qualified buyer verification (because we hate tire kickers, too)

A Seller CRM (to closely track deals in progress)

Data Vault (to upload your docs before buyers ask)

Built-in messaging (so you can track every conversation)

Here’s the simple equation most people miss:

It was never about who “wants” it the most.

It was always about who’s best equipped to make it happen.

This time, it was Sally.

But maybe, next time it could be you.

HIGH SIGNAL

The Builder’s Feed

📊 “A must-read.” Get the only newsletter that makes you a smarter business buyer every time you open it.

🎤 Listen to this: 20 minutes of Codie’s no-fluff advice for Gen Z on living a rewarding life.

🏕️ Just dropped: How we bought unwanted land and set up a glamping business.

DOPAMINE HIT

What’d you think of this week’s newsletter?

Hit reply to let us know. How ya feeling? Did we crush it? Blow your mind? We read every response.

Want your brand in front of hundreds of thousands of business builders?

Check out our sponsorship opportunities.

Want more where that came from?

Head to our website.