We are one of the wealthiest nations in history… and (seemingly) one of the most financially illiterate.

Six-figure earners live paycheck to paycheck. Lottery winners go broke. Celebrities file for bankruptcy after careers that generated hundreds of millions. People are financing their damn DoorDash orders.

From one vantage point, society is sedated by subscriptions, financed burritos, maxed-out credit cards, and minimum payments. We’re bodybuilders with clogged arteries, flexing our consumption. It’s no wonder millennials fear debt more than death or war.

But here’s the paradox: the same tool that holds people back can also build them up. Our relationship with money can be an obvious force for good. Used wisely, it’s jet fuel for everything from Main Street, to mortgages, to microchips.

Over the years, we’ve heard from thousands of people about their relationships with money. The patterns are clear:

For some, it’s a fling. Cash comes in, cash goes out, no commitment or discipline.

For others, it’s a toxic dependency. High earnings with endless debt and constant anxiety.

And for a few, it’s a disciplined partnership designed to compound over time.

Same tool. Radically different outcomes.

But the common denominator? Most of the challenges stem from the fact that people were never taught the first principles of money. Without these, people usually end up on a monetary treadmill (what you probably know as “the rat race”).

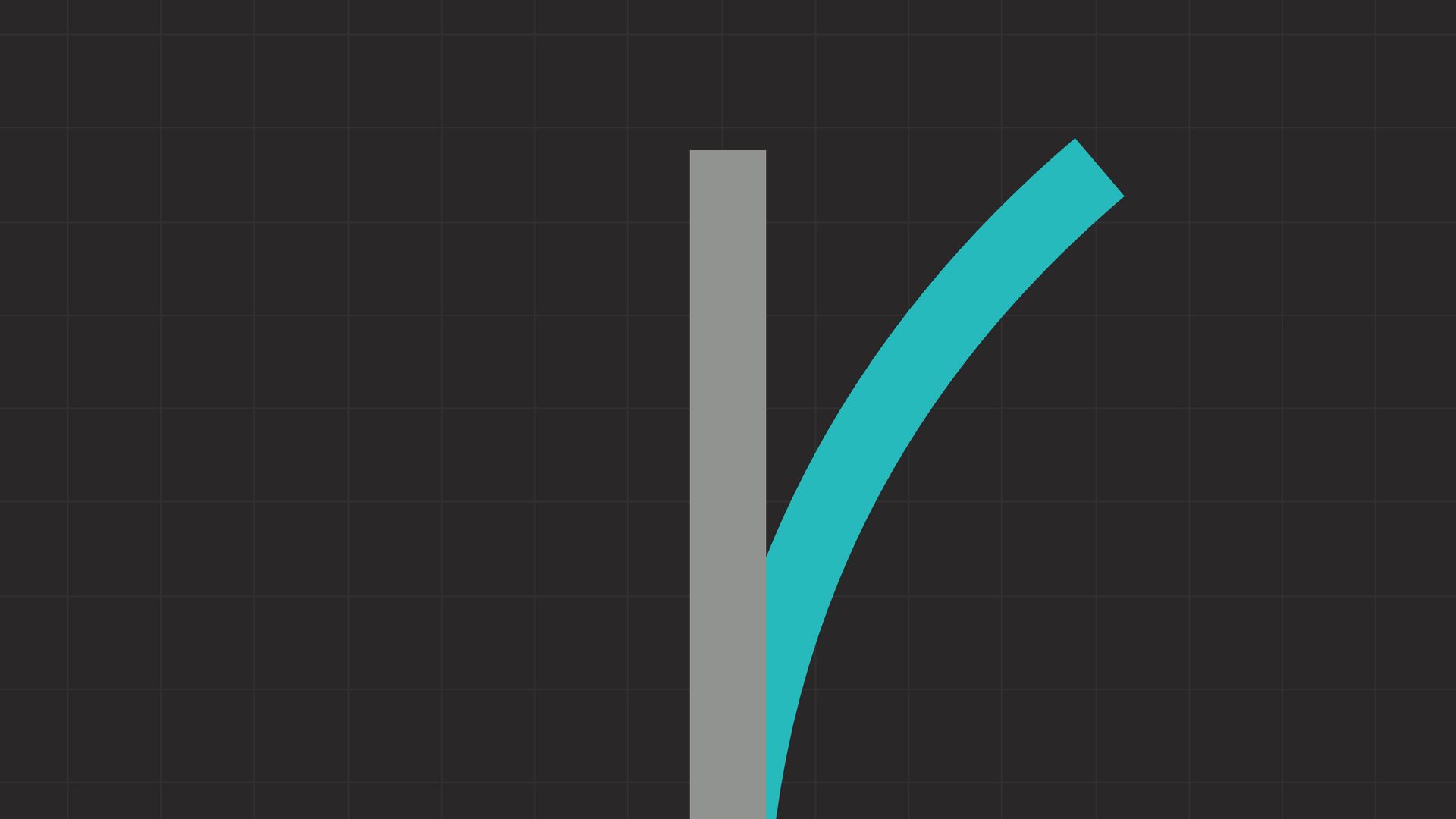

In the rat race, every raise is matched by a new expense. Every windfall is canceled by new debt. The faster you run, the more exhausted you get, but you never seem to get ahead, and you’re too busy to find a way off.

Most people think money is about luck, or hustle alone, or having the right boss. In reality, at its most basic level, it’s about one thing: how it flows.

By the end of this piece, you’ll have a clearer mental model to anchor your entire financial life.

Yes, but first you must understand 2 things:

1. The Consumption Trap

Ask 10 people to define money, and you’ll get 10 variations of the same thing:

“It’s a medium of exchange.”

A better way to think about it: money is stored value.

You trade money for something because you believe the value of that thing is equal to (or greater than) the value of the dollars you gave up.

That’s all it is.

So we always find it weird when someone says, “Money is the root of all evil,” because money itself isn’t good or bad. It reflects the choices we make with it. The same $100 can be used to buy drugs or to fund your kid’s future. The medium is the same. The outcomes are wildly different. Which brings us back to the core question…

What is your relationship with money?

Like we said, at the most basic level, money has a flow: what comes in and what goes out. Your net worth is nothing more than the scoreboard of this relationship.

But here’s the reality: early on, most people’s financial lives are defined entirely by what goes out: consumption.

Managing the consumption trap is not easy, but it doesn’t require genius. It requires the absolute basics of financial literacy:

Face the numbers. Journal your expenses. Most people avoid this because of the Ostrich Effect: the less they look, the less real the problem feels.

Control the flow. Create a budget and live below your means. Decide what you’ll spend before the month begins, and stick to it.

Build a buffer. An emergency fund of 3-6 months of expenses keeps a layoff or hospital bill from wiping you out.

This is the bare minimum.

The weird thing is, most of us grow up taught to worship consumption. Good grades lead to a good job. A good job funds expenses. Expenses define your life. Rent, car, phone, Netflix. Rinse, repeat. Entire economies are built around this cycle.

But here’s the catch: while controlling consumption is absolutely necessary, it rarely makes you truly wealthy.

Most online financial advice lives in the monastery of subtraction. Skip Starbucks. Cut the cord. There are entire cultures designed around consumption habits: FIRE, DINKs, DINKWADs. Their gospel? Save more, spend less. And those are wise things to do.

But the likely best-case scenario for most people is that if you focus 100% of your effort on cutting your spending to very little, congratulations — you’ll still be kinda broke, just more slowly.

Mastering consumption is a prerequisite to building wealth, but it is rarely where wealth is made. That usually comes from the other side of the equation: Production.

2. The Power of Production

When it comes to money, defense keeps you from losing the game, but offense wins championships.

Graham Stephan doesn’t make $100k a month by cutting coupons. Dave Ramsey didn’t build a 9-figure net worth by skipping lattes. They mastered their burn, but eventually moved well past the consumption phase and deep into production, or value creation.

Production is simple to describe, but hard to execute:

Identify a problem.

Create a solution.

Deliver that solution at scale.

The leverage comes from the scale. Cutting a latte might save you $5 here and there, but it’s not going to make you $5 million. Solving a problem for thousands of people and owning part of the business that delivers the solution? That could make you $5 million.

Production takes many forms.

Here at Contrarian Thinking, we are a business that produces extensive educational programs, resources, and events that help people learn how to buy and grow businesses. We also invest in other businesses.

And that’s what’s key: what matters isn’t whether you own the whole pie or just a slice; it’s that you own something that can produce value for you non-linearly.

That might mean building a business. But it could also mean owning a small part of one, like equity in a franchise or in the company you work for.

Whatever the case, the most powerful way to capture value created is through ownership.

There are no shortcuts to getting there, but there are paths.

The rat race is real. But you don’t escape it by running faster. You escape it by changing the path you’re on.

Don’t forget it.

JOIN US THIS NOVEMBER

Our Biggest In-Person Event. Ever.

We just wrapped our Main Street Millionaire Live 3-day event. Thousands of you joined us virtually to deep dive into deal origination, negotiation, acquisition, and much more.

Now it’s time to take it offline.

Our next multi-day event is happening IN PERSON in Austin, TX, November 2–4, 2025.

It’s called Main Street Over Wall Street, and the lineup is stacked: renowned CEOs, investors, government officials, and entrepreneurs all focused on one mission: building and backing small business.

👉 Check out the speakers and schedule here. Early Bird pricing ends soon.

ONE LAST THING…

📊 Get the only newsletter that makes you a smarter business buyer every time you open it.

DOPAMINE HIT

What’d you think of this week’s newsletter?

Hit reply to let us know. How ya feeling? Did we crush it? Blow your mind? We read every response.

Want your brand in front of hundreds of thousands of business builders?

Check out our sponsorship opportunities.

Want more where that came from?

Head to our website.