Are you about to get rich from AI… or wrecked by it?

And are we in a bubble?

Today, we’re breaking down what’s real, what’s hype, and how you can play it smart either way.

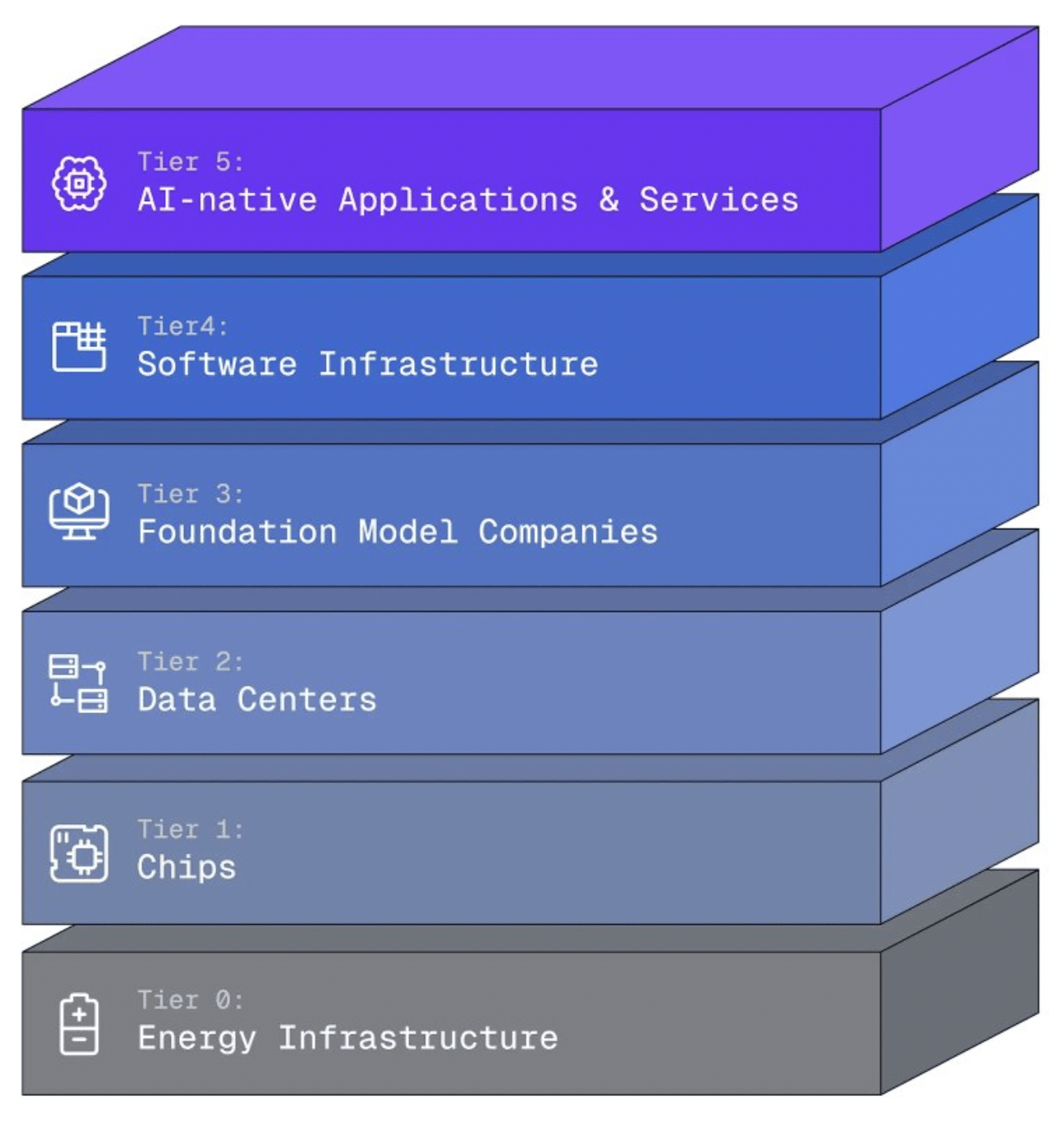

But to do that, first you need to know the 6 Tiers of AI. This is the exact framework that billionaires we personally know are using to decide where to put their money.

The 6 Tiers of AI

The founder of Palantir, Joe Lonsdale, shared this at our conference the other week. (And if you missed it… You might want to sign up on our waitlist for next year right here.)

This framework shows you exactly where to look as AI reshapes the world.

Here’s how it works.

Tier 0: Energy Infrastructure

AI may live in the cloud, but it eats electricity for breakfast.

This is the stuff AI literally runs on.

That’s why some of the biggest investors in the world are focused right here.

Because without energy, there is no AI.

According to the International Energy Agency, our data center energy demand will more than double by 2030, and will use more power than entire countries.

Tier 1: Chips

This is the hardware and specialized processors that power AI itself. The “brains” or “central nervous system” of AI, if you will.

The work here is ruthlessly intense. We’re talking hundreds of billions of dollars, and full-on geopolitical arms races around who controls chip manufacturing.

Think of this as the “picks and shovels” layer of the AI gold rush.

Tier 2: Data Centers

Next stop: where all those chips live. Data centers are the “bodies” that host and scale AI workloads.

That’s why you’re seeing an AI construction boom.

Last year, global investment in data centers hit $455 billion, up 51%. And the big four (Amazon, Google, Meta, Microsoft) spent nearly all their $250 billion in CAPEX here.

For you and us, the real money likely won’t be in owning these centers.

BUT there is an enormous small business ecosystem that builds, supports, and maintains these centers. Electricians, HVAC, plumbing, and roofing businesses. AI can’t exist without them.

Tier 3: Foundation Model Companies

This is where the tech giants spend a lot of their time and energy. Think: OpenAI, Anthropic, xAI, Google, Meta.

They’re building the base models everyone else builds on top of. Massive capital, massive compute, massive competition.

Only a few players can even afford to play here. Why? These companies require massive upfront capital to train their models.

Tier 4: Software Infrastructure

These are the tools that make AI usable downstream. The orchestration, monitoring, and deployment platforms. Think of them like the AWS of AI.

They make it possible for companies to deploy and scale AI efficiently.

Tier 5: AI-native Applications & Services

This is where you and I actually feel AI the most.

These are apps, services, and tools that are changing how people and businesses operate. Think:

Better document processing of legal contracts, financial statements, medical records, and operational logs.

Automated browsers that can scrape the web for you and navigate user interfaces designed for humans.

Voice and conversational agents that can do customer support calls, negotiate with vendors, and understand complex requests.

Every new advancement in an upstream stage enables new categories of products & companies to at a downstream stage.

And now that you know how the AI machine is built, let’s talk about the human side of all this.

The Psychology of Bubbles

As the writer Derek Thompson put it,

“People think artificial intelligence will be the most important technology of the 21st century. Others insist that it is an obvious economic bubble. I believe both sides are right… AI will rise first, crash second, and eventually change the world.”

Let’s step back in time.

In the 1630s, people lost their minds over tulips.

Not faster, not prettier, not more functional tulips… just tulips.

Every boom, every bust, every “new era” starts the same way, like this: with people convincing themselves this time is different.

Of course, the tulip bubble eventually popped. Bubbles like that are particularly fragile. They pop fast and rarely take the economy with them.

But bigger bubbles, the trillion-dollar bubbles, the bubbles where something may actually be different this time, can occur when psychology overlaps with legitimate innovation. It looks like this:

A world-changing innovation appears

Capital floods the market

Valuations increase

Speculators add fuel to the fire

The bubble grows

And grows

And grows

At their core, major bubbles are often based on some truth.

The dot-com bubble of the late 90s was predicated on the promise of the internet. Another example: The resilience of crypto and blockchain after the NFT bubble indicates it likely will be here to stay.

FYI, this is why you should probably never try to time the market. It’s time IN the market that’s more important over the long term, as Buffet says.

Here’s the thing. Nobody — not us, not you, not even Sam Altman — knows exactly what’s going to happen with AI.

So Sure, There May Be a Bubble

To put into perspective just how much money is being put into the AI buildout…

Tech companies will spend about $400 billion just this year on AI infrastructure (and this will rise in the coming years).

The entire Apollo program spent about $300 billion in inflation-adjusted dollars to get us to the moon.

This has already impacted broad swaths of our entire economy.

The top 10 stocks in the S&P 500 account for around 40% of the index’s market cap.

Since ChatGPT launched, AI-driven stocks have garnered 75% of S&P 500 returns

AI investments are responsible for 90%+ of U.S. GDP growth this year

As the Financial Times put it:

“America is now one big bet on AI. AI better deliver for the U.S., or its economy and markets will lose the one leg they are now standing on.”

With trends like these, the math must make sense to back it all up… right? Right?! A lot of smart people aren’t so sure. Here are 3 major reasons why:

1. Sky-high valuations, few products

One example of this is Thinking Machines, the AI startup founded by former OpenAI executive Mira Murati, which raised $2 billion at a $10 billion valuation.

That may not sound that wild to you… until you learn the company reportedly didn’t even have a product. It was just the talent that was being bet on at those numbers.

2. Unprecedented spending-to-revenue gap

Total AI capital expenditures in the U.S. are projected to exceed $500 billion in 2026 and 2027.

But large companies are still trying to figure out how AI can save them money and grow faster, and the answers aren’t all so obvious just yet.

The investor and writer Azeem Azhar has estimated that annual AI-related data-center spending in 2025 is around $400 billion, while AI revenue this year will total about $60 billion.

That’s a 6x-7x gap. For context, Derek Thompson found that:

Telecom companies during the dot-com fiber-optic bubble saw about a 4x gap

The railroad companies in the 1870s saw a 2x gap.

3. Circular financing patterns

This may be the weirdest one.

Bubbles are often seen as being the result of over-engineered financial setups failing, or an over-investment in an over-optimistic timeline.

Some people are worried that some of these things may be happening here.

Namely, they’re worried that the big tech and AI companies are all… (excuse our language) sleeping with each other. Take a look at this chart from Bloomberg.

It makes you dizzy.

Nvidia and AMD are investing in companies they sell to.

Anthropic is using Amazon’s web services, and Amazon is an investor in Anthropic.

Microsoft invested in OpenAI and counts OpenAI as a customer.

Some have referred to this general trend as resembling a form of “circular financing,” where dollars trade between firms, clouding actual demand.

Plus, the trillions of dollars represented above don’t touch even close to everything. And still, even so, there may not be a bubble…

There May Not Be a Bubble

Here’s the funny thing.

Jeff Bezos called it “an industrial bubble.”

Bret Taylor, chairman of the board of OpenAI, said, “I think we’re also in a bubble.”

Goldman Sachs’ CEO said there will be a “drawdown.”

Jamie Dimon said he’s “far more worried” than others about a big correction.

It seems like everyone is saying there may be a bubble on our hands. And yet… nobody’s really acting like it. Why is that?

During the dot-com bubble, Telecom firms were laying fiber-optic cable like crazy. They laid so much cable that, at a point in 2005, ~85% of broadband capacity in the U.S. was reportedly going unused.

That’s actually why they used to call it “dark fiber.”

What’s happening today doesn’t appear to be like that…

Revenue is actually growing really fast.

The valuations of today’s tech giants, while giant, are also closer to earth than the dot-com bubble’s sky-high multiples.

As Derek Thompson put it:

“In 1999, companies like Oracle and Cisco traded at 100x forward earnings. Today, Nvidia, Microsoft, Apple, Alphabet, Amazon, and Meta are all below 30x. By that metric, even Netflix (trading around 40x forward earnings) looks more overvalued than Nvidia, and no one’s calling streaming TV a bubble in 2025.”

The bottom line, he says, is that AI may actually be so novel, so unlike anything that’s ever happened, that we may not really be able to compare it to anything in either direction.

“AI might actually be a once-in-a-century general-purpose technology — something closer to electricity than to e-commerce.”

And if these companies do in fact develop AGI (artificial general intelligence), which is one of their stated goals, then “all bets are off.”

That’s Out of Your Control, So Focus on This Instead…

Right now, 2 massive adoption problems will decide who makes money and who gets left behind in this next era.

Understanding these can help you win, pretty much no matter what happens here.

1. People take their time to figure sh*t out, so move fast now

An underrated bottleneck in AI isn’t computing power, but human creativity.

Companies can sell you endless new models. But if you don’t know really how to wield them, then what good are they to you?

The real opportunity we see? Learning how to apply new tools in ways that actually drive efficiency and make money.

Harvard and Stanford researchers recently found that some workers are spending more time correcting AI output than doing actual work.

McKinsey found that nearly two-thirds of respondents say their organizations have not yet begun scaling AI across the enterprise.

If you can get out ahead of these trends, you will win.

2. Focus on solving real problems in your real workflow

OpenAI, Anthropic, xAI, Google… They are all racing to make chatbots that each sound a little bit smarter than the last.

When every product looks and acts the same, prices drop fast.

That’s amazing for users, but tough for the companies.

And with open-source and Chinese models offering strong performance for a fraction of the cost, the big labs could get increasingly commoditized.

As one Goldman Sachs analysis put it:

“Competition is often underestimated, and the returns on capital invested by the innovators are typically overstated.”

That means some of the real winners in the coming years won’t just be the model-makers, but scrappy operators who use their tools to build moats.

So what’s the play?

For you, the biggest benefits will likely come in the form of AI agents. These are AI tools that help you complete actual, complex workflows.

Today, many of them work “okay.” But a year from now, they will probably be ridiculous. Certainly, 2 years from now.

They are digital specialists who you can oversee to do things like handle customer service, schedule appointments, close sales, negotiate deals, and much more.

Agentic AI “understands goals and can autonomously plan, make decisions, and take initiative without constant human direction,” according to Vista Equity Partners.

“It can direct other AI agents to do tasks and delegate individual pieces of work, like making calculations or retrieving data from another system.”

For you, that will eventually mean having an army of sidekicks capable of managing workflows end-to-end.

62% of McKinsey survey respondents say their organizations are at least experimenting with AI agents. And 60% of the software market could be made up of agents by 2030, according to Goldman Sachs.

One reason that is so powerful is that it’s a margin driver.

Whether you like it or not, this is becoming the way of the world.

Good news for you is, bubble or not, it probably doesn’t matter.

Don’t spend you’re time trying to predict the next Nvidia.

You’re much better off playing with new AI tools to build faster, cheaper, and smarter than your competitors.

Do that, and if this is a bubble, you’ll still be doing better business when it pops.

Either way, you win.

-Team Contrarian

ONE LAST THING…

💰 Join Codie on November 18 @ 6pm CT for Your Ownership Roadmap, a free live virtual workshop on the 10 steps to buying a cash-flowing business that’s right for you. (Save a spot here.)

📊 Get the Main Street Minute, the only free newsletter that makes you a smarter business buyer every time you open it.

DOMPANIE HIT

Great idea…

What’d you think of this week’s newsletter?

Hit reply to let us know. How ya feeling? Did we crush it? Blow your mind? We read every response.

Want your brand in front of hundreds of thousands of business builders?

Check out our sponsorship opportunities.

Want more where that came from?

Head to our website to learn more about our programs.