Folks, we work with hundreds of scaling business owners every day.

Most people run their business until they're miserable… And then they try to sell it.

Don't be most people.

Build a business so it's sellable… and you'll never have to sell.

The Backwards Approach: Start with the End in Mind

Here's the secret to building a sellable business: You need to work backwards from what makes a business valuable in a buyer's eyes.

When you understand what buyers are looking for, you can design your business to be valuable whether you sell it or keep it.

Because the qualities that make a business attractive to buyers are often the same ones that make it attractive to you as an owner.

🗓️ Time is running out: In just 15 days, we’re giving you the complete roadmap to buying a business in our most valuable virtual event ever.

How Buyers Think About Value

To build something valuable, you need to understand how buyers calculate what they'll pay. Let's break it down.

The 4 things everyone will want to audit…

Simplicity check: If you can't explain what you do in one clear sentence, you probably can't systematize it. Complexity might impress people, but it doesn't transfer well.

The bus test: Imagine you vanish tomorrow. What percentage of operations continue normally? If the answer is close to zero, you're selling a job, not an asset. (That’s fine for some, just be honest about it.)

Dependency scan: Look at your top customer, your critical supplier, and your key employee. If losing any single one would crater the business, that's a vulnerability worth addressing.

Value definition: What's actually changing hands in a sale? The clearer you can articulate this (equipment, customer relationships, processes, brand), the more confident buyers become.

As you build, keep asking yourself these questions.

The Recipe for a Great Multiple

Want to sell your business for a premium multiple? Here's what matters most:

Be profitable. No profits, no sale.

Be growing. Upward trajectory commands premium pricing.

Be diversified. Multiple customers, channels, and products reduce risk.

Be predictable. Recurring revenue + steady growth. People want to be able to forecast.

Get these right and buyers will be confident in what they’re buying. Buyers can overlook slow growth or some customer concentration, but they probably won't pay a great multiple for it.

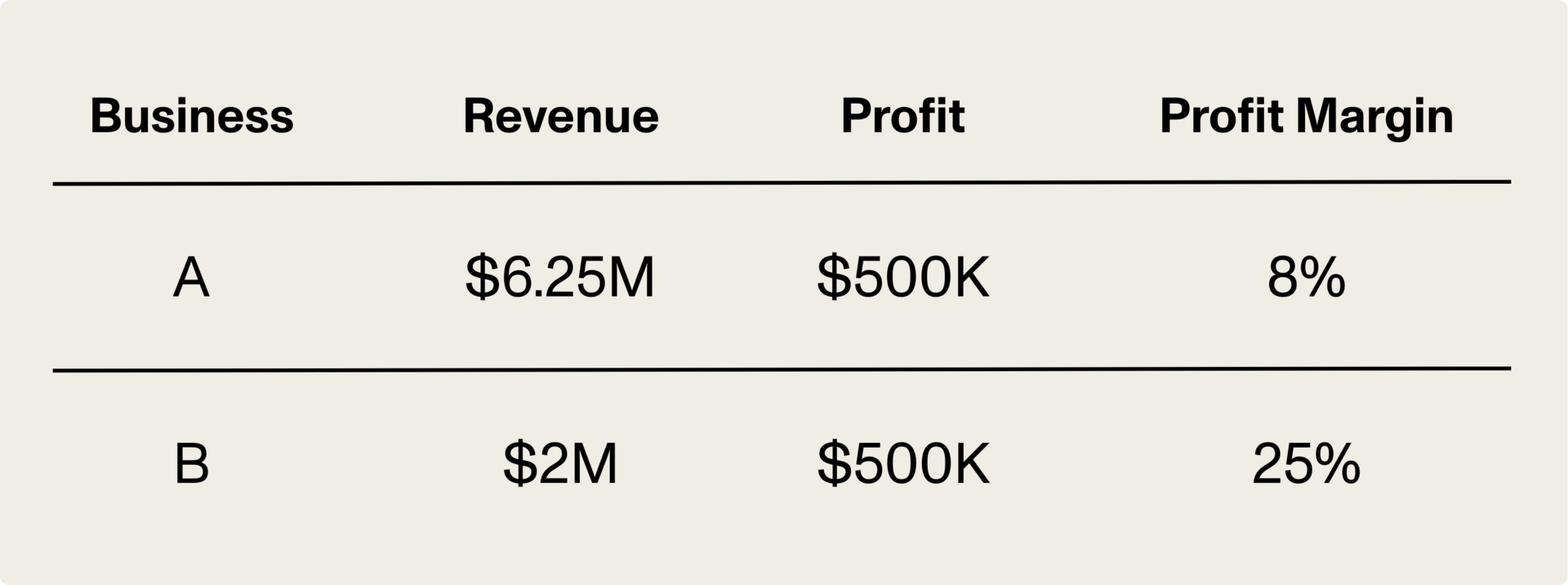

The bottom line: Profitability alone is necessary but not sufficient for a great multiple. Consider two businesses that have $500K profit but different margins:

Both produce the same $500K outcome, but Business B is far more efficient and has great room for error.

The SDE Formula: How Main Street Buyers Calculate Value

For Main Street businesses (roughly $500K to $5M in revenue), buyers use a metric called Seller's Discretionary Earnings (SDE) to determine the value the business generates for them.

SDE is considered the true earning power of your business. It's what you'd make if you owned the company debt-free, worked in it full-time, paid yourself $0, and only paid necessary expenses. It's the maximum theoretical earnings in a normal year.

Let's walk through an example for an HVAC business.

Notice how the net profit of $85,000 transforms into SDE of $201,000. That's 2.4X higher. This is why understanding SDE is critical both for building and valuing a business effectively.

One layer of nuance: In this example, we’re “adding back” the owner's salary because the buyer is going to be doing the work.

The Multiple: What Determines Your Final Value

Once you have your SDE, buyers multiply it by a number (the multiple) to arrive at your business value. Here are some typical ranges:

Using our HVAC example: With $201,000 in SDE, let's say this business earns a 3.2X multiple based on industry comparables and its specific strengths. That means:

$201,000 SDE × 3.2 multiple = $643,200 business value

But that’s just a generalized estimate. Where your business specifically lands depends on quality factors we'll cover soon.

The Seller’s Reality Check

Buyers will be doing quick napkin math to think practically about whether the deal makes financial sense. They’ll ask: Can I make a living, service the debt (if using an SBA loan), and still have a margin for error?

Back to our HVAC example:

Annual SDE | $201,000 |

|---|---|

Less: Owner salary needs | ($75,000) |

Less: Debt service (SBA loan at ~$515K, 10 years, 11%) | ($85,000) |

Remaining cushion | $41,000 |

That's about a 20% cushion, which sounds relatively workable, but the actual numbers are very tight. For example, $40k is not enormous in the scheme of things. Regardless, buyers typically want to see 25% or more for safety. This math has to work for your ideal valuation to be realistic in the market.

Now Let’s Build Your Sellable Business

These are the building blocks that make your business more valuable. Buyers look for:

Higher than normal profit margins

Recurring revenue (contracts, subscriptions, retainers)

Documented systems and processes

Strong reputation and online presence

Newer equipment and updated technology

Diversified customer base (no concentration risk)

Growth trajectory (SDE increasing year over year)

Low owner dependency (business runs “without” you present)

Start building toward them today, and place significant focus on these:

1. Diversify Everything (The 15% Rule)

Diversification is about reducing risk, and buyers will pay more for lower-risk businesses.

The 15% Rule: Aim for no single client to represent more than 15% of your revenue. If it makes sense, apply the same thinking to product lines and key suppliers.

Example: If you have $1M in annual revenue, your largest client should ideally represent no more than $150K. If one client makes up $400K of your revenue, that's 40% concentration. It's a red flag.

Work intentionally to diversify. If one client leaves or one product becomes obsolete, your business keeps running.

2. Build Recurring Revenue

Revenue is essential. Predictable revenue is valuable. Recurring contracts, subscriptions, retainers, and maintenance agreements transform your cash flow from lumpy to smooth.

Example: That HVAC company with $201K SDE? If 30% of their revenue came from recurring service contracts instead of one-time installs, their multiple might jump from 3.2X to 3.8X. That's an extra $120K in multiple value. Always look to find ways to convert one-time transactions into ongoing relationships.

3. Reduce Owner Dependency

A business that collapses without you isn't sellable. Period. Work toward a state where if you disappeared tomorrow, most things would still get done.

This means hiring capable people, delegating responsibility, documenting processes, and building systems. It also might mean creating incentives (equity, profit sharing, bonuses) to retain key people post-sale.

Think of it this way: The more the business needs you specifically, the riskier it is (and the less it's probably worth) to someone else.

4. Optimize for Cash Flow

Buyers want businesses that generate cash, not businesses that consume it. Do everything you can to optimize cash flow:

Get paid upfront or require deposits

Shorten payment terms (net 30 instead of net 60)

Cut unnecessary expenses

Negotiate better terms with suppliers

Manage inventory efficiently

5. Maintain Growth or Stability

If your SDE is climbing year over year, you're golden. Buyers pay premiums for momentum and positive trajectories. The opposite is also true.

If your numbers are erratic or declining, they'll question everything, discount heavily, or walk away.

Critical reminder: Once you enter a deal process, don't take your foot off the gas. Any dip in performance will be noticed, extrapolated, and questioned. Keep selling, keep executing.

6. Invest in Systems and Technology

Buyers love businesses that run on systems. Better technology, documented workflows, clean books, professional websites, and modern equipment all signal that your business is mature and stable. The more systematized, the less risky it looks.

7. Build Strong Margins

If your margins are higher than the industry average, your multiple goes up. Focus on operational efficiency. Cut waste. Optimize pricing. Improve your value proposition so you can charge more.

Fat margins don’t guarantee it, but they signal a risk-averse business, and they’re especially appealing to a buyer who will likely have to use an SBA loan to acquire your business.

Here's the beautiful irony

When you build a business that's designed to sell, you often end up with a business you never want to sell.

A business with recurring revenue, diversified clients, strong systems, low owner dependency, and healthy cash flow is a business that runs well, scales easily, and gives you freedom.

Work backwards from what buyers want. Build those qualities into your business. And whether you sell or keep it, you win.

-Team Contrarian

🤝 Want to learn how to buy a business? We’re giving you the complete roadmap to getting started in our most comprehensive live training yet. Happening virtually in 15 days. Save your spot ASAP.

DOPAMINE HIT

What’d you think of this week’s newsletter?

Hit reply to let us know. How ya feeling? Did we crush it? Blow your mind? We read every response.

Want more where that came from?

Head to our website to learn more about our programs.